The forex trading industry, like all other industries, has its important terminologies. Some of these terms are relatively easy to use and understand. For example, any forex trader knows what a pip and a currency pair are. However, there are other terminologies used mostly by advanced forex traders. In this article, we look at some of those terms, what they mean, and how you can use them in forex trading.

Arbitrage

Arbitrage is a concept used in forex trading and other financial sectors. While it may sound a bit complicated, in reality, it is a relatively easy concept that forex traders use. Arbitrage refers to the process of trading two currency pairs that have some relationship. This relationship is known as correlation.

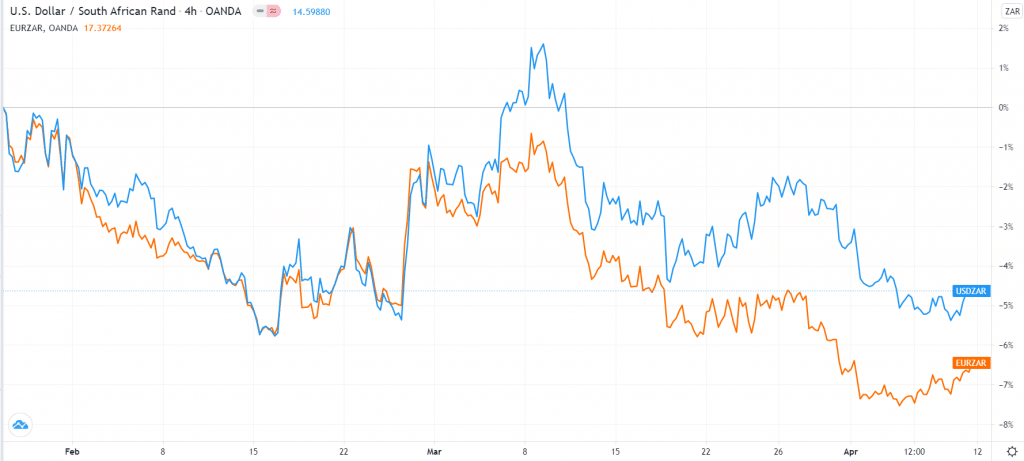

Arbitrage is based on the idea that several currency pairs move in a similar or exact direction. For example, in most cases, currency pairs like the NZD/USD and AUD/USD pairs tend to move in the same direction. Similarly, pairs like the USD/ZAR and GBP/ZAR usually move in the same direction. That’s because when the South African rand falls against the US dollar, it also falls against other major currencies.

USD/ZAR vs. EUR/ZAR

Therefore, most advanced arbitrage day traders use the similar direction that these currency pairs have to trade. In the case of the South African rand, the USD/ZAR and EUR/ZAR are trading at 14.6 and 17.2, respectively.

Therefore, if the trader believes that the USD/ZAR price will fall, they can short the USD/ZAR and simultaneously buy a small amount of the EUR/ZAR pair. In this case, if the trade works out, the USD/ZAR trade will make a profit while the EUR/ZAR will make a small loss. The profit for this trade will be the difference between the profit and loss.

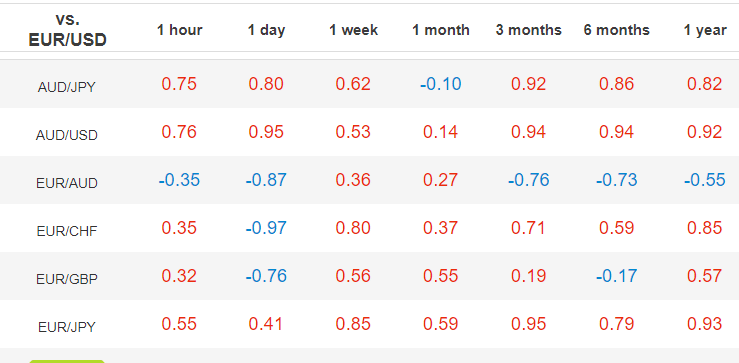

To use arbitrage, advanced traders use the mathematical concept of correlation. The chart below shows a free currency correlation tool offered by Oanda. In this case, if the pairs have a correlation of 1, it means that they are perfectly correlated. If they have -1, it means that they are inversely correlated, and if they have 0, it means that they have no relationship.

Currency correlation table

Carry trade

Another popular forex trading jargon used by advanced traders is known as carry trade. It is not popular among new traders. It refers to a situation where a trader borrows a low-yielding currency and buys a higher-yielding one. By simply doing this trade, a broker will pay you the rate difference between the two.

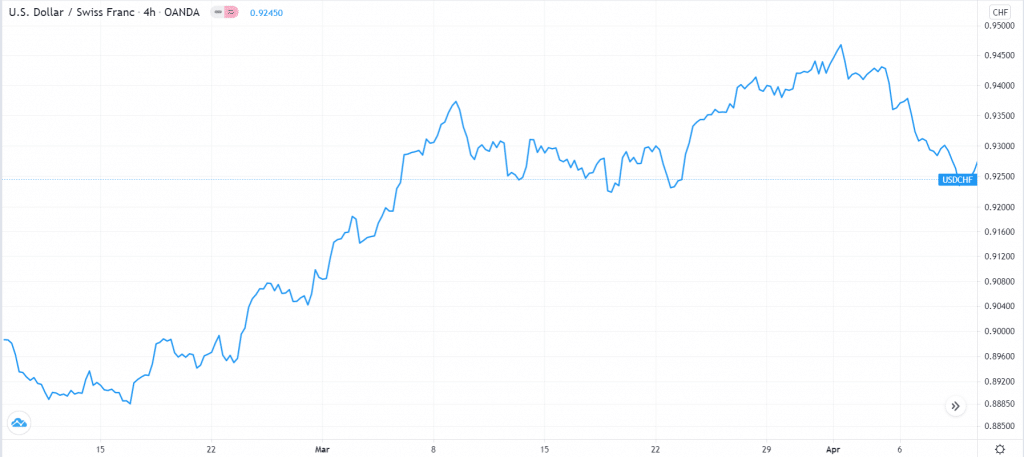

A good example of popular arbitrage opportunities is in the USD/CHF pair. In response to the coronavirus pandemic, the Swiss National Bank (SNB) slashed interest rates to -0.75%. This made it the lowest in the world. In the United States, the Fed lowered to zero. Therefore, there is a wide spread between the two.

As such, since the Fed will likely hike rates earlier than the SNB, traders can borrow the Swiss franc and buy the high-yielding US dollar. Indeed, this is partly the reason why the USD/CHF pair rose in the first quarter of 2021.

USD/CHF carry trade

Slippage

Slippage is another forex term that advanced day traders know about well. It is a situation where the price you execute a trade at is the same where it is finally executed by the forex broker. For example, you might execute a buy order at 1.1200 only for the broker to open the trade at 1.1205. While this is a small difference, the impact on your trading can be major.

Slippage happens mostly in periods of high volatility or when you are trading illiquid currency pairs. To understand why this happens, you need to know how forex brokers work. Most brokers use an electronic communication network (ECN) to process orders. So, when you open a trade, the broker usually directs it through an ECN. This slippage can happen when there is a delay in matching your order with other market participants.

There are several strategies to reduce slippage. First, instead of using market orders, you can focus on pending orders like buy stop and sell limit. A buy stop will open a bullish trade once a currency pair moves above the current price. Similarly, a sell stop sells a currency pair below the price. Second, you can avoid slippage by avoiding currency pairs in periods of high volatility, such as when a central bank is about to deliver a decision. Finally, avoid illiquid currency pairs.

Risk-on and risk-off

Risk-on and risk-off are two terminologies that experienced forex traders use in their trading. Risk-on refers to a situation where investors are willing to buy risky currencies and other assets.

Among the most popular types of risky currencies are those from emerging markets like the South African rand and Mexican peso. This happens when the Federal Reserve and other major central banks have embraced an expansionary policy. For example, in 2020, the dollar declined because of the risk-on sentiment in the market.

The risk-off sentiment is when the market is fleeing from volatile currencies to safer ones like the US dollar and the euro. This happens in periods of high risks, such as when there are geopolitical risks.

Golden cross and death cross

The golden cross and death cross are two terms that are also used widely by advanced day traders. The idea behind them is relatively simple. A golden cross is a situation when the 200-day EMA and 50-day EMA make a bullish crossover. It sends a message that the new upward trend will continue. A death cross, on the other hand, happens when the two moving averages make a bearish crossover. It confirms that a new bearish trend has started.

While the two crosses are known, in reality, they work well for long-term investors. Instead, forex day traders use smaller numbers such as 15-day and 25-day instead of the 200-day and 50.

Final thoughts

There are many forex trading jargon in the market. In this article, we have just looked at a few of them. To become a better trader, we recommend that you spend time reading the popular forex glossaries. Also, whenever you see a term that you don’t understand, take time to learn more about it.

Leave a Reply