Forex majors refer to currency pairs of the developed countries that have the US dollar as the base or counter-currency. In 2020, the main underlying concern of most currency majors was about the weaker US dollar.

The dollar rose in the first three months of the year as the Covid-19 pandemic started to spread internationally. For the rest of the year, the currency declined and is now at the lowest level since 2018. Let us look at the overall outlook for these currency majors in 2021.

US dollar index has been in a freefall.

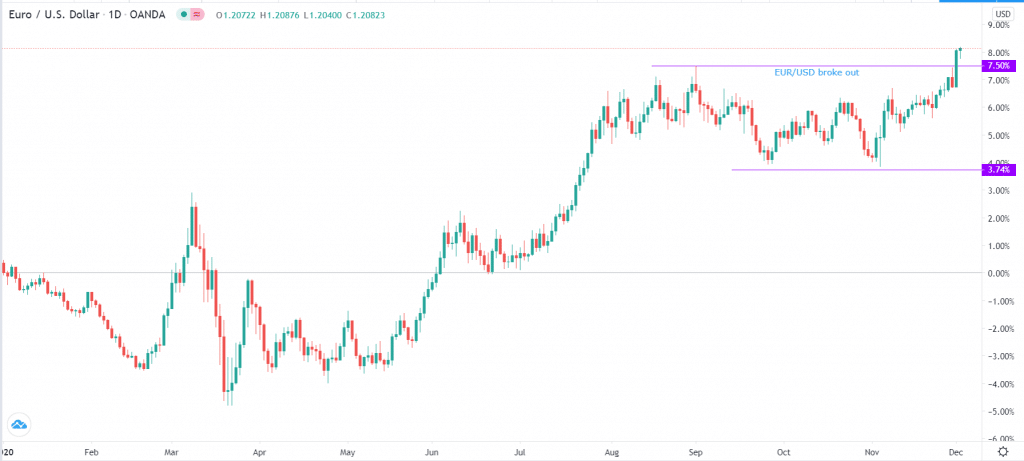

EUR/USD

The EUR/USD has been on a strong upward trend this year. As of this writing, the currency is trading at 1.2080, which is the highest it has been since April 2018. In total, it has jumped by more than 13.50% from its lowest level in March.

There were several key movers for the pair in 2020. First, in July, European leaders passed the landmark 750-billion-euro recovery package after weeks of bickering between northern and southern states. These funds will be provided as loans and grants to help countries recover from the pandemic.

Second, like all central banks, the European Central Bank (ECB) has been relatively active in supporting the bloc. The bank lowered interest rates further into the negative territory and unveiled a 1.35 trillion euro quantitative easing package.

Third, in general, the European Union managed to handle the pandemic better than most countries. The region has had fewer infections and deaths than in the US. Finally, there was hope that the EU and the UK will ultimately reach a Brexit agreement.

Looking ahead, in 2021, with countries expected to deliver vaccine shots, the main topic will shift to the fiscal situation in the bloc. That’s because many countries like Italy and Spain have already taken a substantial amount of debt to fund the recovery. Also, there will be a focus on the ECB and whether it will start tapering on asset purchases.

EUR/USD has jumped by 7.5% this year

GBP/USD

At the peak of the Covid pandemic in March, the GBP/USD dropped to 1.1435, which was the lowest it has been since 1985. Since then, it bounced back and soared by more than 15% mostly because of the weaker dollar.

In 2020, there were three main events that had an impact on the pair. First, Brexit talks between the UK and the EU continued. As of this writing, a deal between the two sides has not been reached, but there is a sense of optimism that the two sides will reach an agreement. Furthermore, the stake is extremely high, considering how the two sides are integrated.

Second, the Bank of England (BOE) also slashed interest rates to almost zero and announced a quantitative easing program to support the economy. Throughout the year, there was talk about negative interest rates, which the bank in question was considering.

Third, there were concerns about the UK’s debt as the total public debt crossed £2 trillion. With the government’s furlough program continuing, there are still concerns about what Rishi Sunak will do to fill the deficit.

Looking ahead, in 2021, the focus will remain on Brexit. If the country leaves the EU without a deal, there will be a significant impact on sterling. On the other hand, if there’s a deal, the focus will shift to other things like the Bank of England and the relationship between the UK and the US. In my view, we will possibly see a reversal, where the dollar gains as global risks start emerging again.

NZD/USD

The NZD/USD has had a great 2020. After dropping to a multi-year low of 0.5468, the pair bounced back by more than 28%. That made the New Zealand dollar the second-best-performing currency major.

There are three main reasons why the kiwi did well. First, New Zealand was one of the best countries in its response to the pandemic. It only confirmed less than 1,600 cases and just 25 deaths. As a result, most business activities, except in the hospitality industry, continued to do well. Second, New Zealand had a relatively peaceful election that led to no disruptions.

Third, the Reserve Bank of New Zealand unleashed its monetary tools to support the economy. It lowered interest rates and offered other tools. Most importantly, the bank ruled out against negative rates, as the governor had warned before.

Finally, New Zealand is mostly an agricultural country. This means that, unlike other resource-reliant countries, it is often less affected by global issues like a recession. Furthermore, people will always eat.

Looking ahead to 2021, I believe that the NZD/USD will pare back some of those gains because the pair has become extremely overbought. The dollar is also becoming significantly oversold.

NZD/USD is extremely overbought

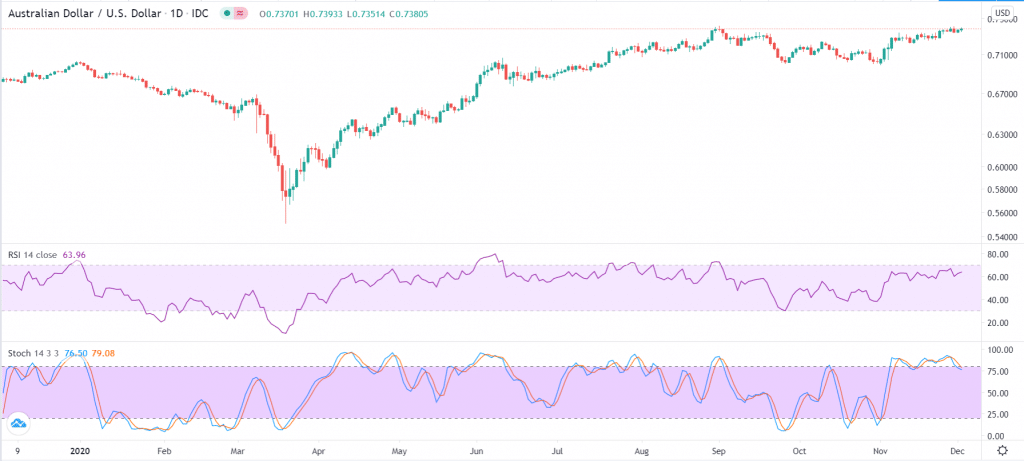

AUD/USD

The AUD/USD pair is the best-performing forex major this year. It has soared by more than 34% from its March lows. Also, it rose in 7 of the past nine months.

In general, the Australian dollar rose mostly because of the weaker dollar. Further, the actions by the Reserve Bank of Australia (RBA) helped to boost sentiment in the country. It lowered interest rates, warned against negative rates, started quantitative easing, and offered term funding for companies.

Most importantly, higher commodity prices, strong demand from China, and the country’s handling of the pandemic helped push more investors to the Aussie. These gains were offset by the recent conflicts between Australia and China.

China has accused Australia of taking the side of the United States. For example, the country moved to ban Huawei from its networks. It also supported an investigation about the origin of the virus.

Looking ahead, we suspect that, like the NZD/USD, the AUD/USD will have a pullback as investors move back to the dollar.

AUD/USD has been a strong performer in 2020

Summary

The overall theme of currency majors in 2020 was about the weakness of the dollar. The greenback weakened because of the victory of Joe Biden, reduced risks with the covid vaccine, and the open-ended quantitative easing by the Federal Reserve.

In 2021, we believe that the dollar strength will start returning as investors start focusing on the fiscal hole that most countries have dug. Most importantly, most currency majors are already overbought, which will possibly lead to a reversal.

I guess the good thing about the dollar being so low is after the crisis is over it has no choice but to rise again.