The main hypothesis of Forex fundamental analysis is that the real value of a security may not match its price. Thus, the price may be incorrectly stated by several markets, but it gradually returns to the original price. The ultimate objective of fundamental analysis is to find out the original value of the security, weigh it up against the current price, and pinpoint an occasion for investment.

Technical analysis, in contrast, is mostly concerned with the current price, which makes it more suitable for those trading short-term patterns. But, if you wish to know what occurs in the Forex market in the distant future, fundamental analysis is what you have to rely on.

What is Fundamental Analysis?

Fundamental analysis involves studying the Forex market based on socioeconomic and political factors that might impact the price of currencies. It describes the practice of investing solely based on global factors influencing the supply and demand of equities, assets, and currencies. Some traders use both while making their trading decisions while some have a preference.

It does not only involve the comparison of historical and current data. Fundamental analysis depends on several economic theories that help you contextualize the data so that you can compare it. Let us look at some of the major economic indicators in this regard.

Major economic indicators

The major economic indicators in Forex fundamental analysis are as follows:

- Interest rates. For money lenders and financial institutions, the interest rate is an extremely important economic indicator. By charging different rates for borrowers and depositors, banks can make some profits. With a rise in interest rates, it is harder for them to pass on the expenses to their clients.

A lower interest rate is more favorable for a bank as the savers start to make speculations. This also leads to people relying on equities in order to battle inflation and set some money aside as a retirement fund. Thus, the demand for money management institutions is created in this scenario.

Here is the interest rate forecast for some of the countries in the Americas over the next few quarters.

- Inflation. As the economy of a region grows, the volume of money circulating also keeps growing. Central financial organizations and governments must try to maintain the optimum inflation level. When the inflation is too great, the supply exceeds the demand and as a result, the value of the currency falls.

Conversely, deflation occurs when the price of commodities decreases as the value of money goes up. This is good for the short-term because long-term deflation leads to a scarcity of money. Here is the inflation rate forecast for some of the countries in the Americas.

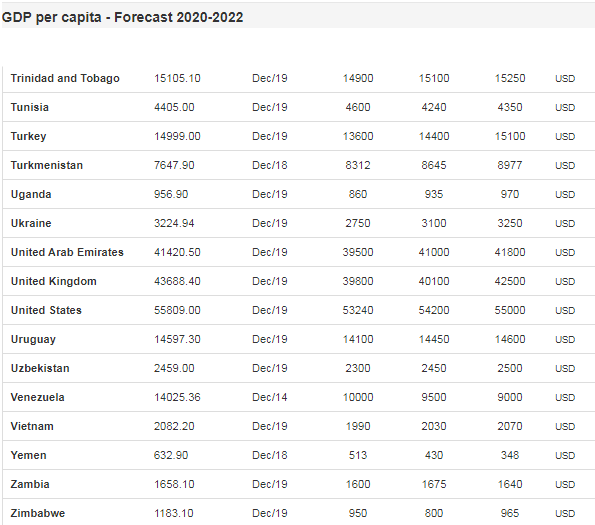

- Gross Domestic Product (GDP). This economic indicator calculates the output of goods in a country that reflects the overall wellbeing of the economy. When traders look at information related to GDP, they check whether the value rises or falls below what was estimated.

If the GDP is less than expected, it means the domestic currency will weaken with respect to other currencies. Whereas, when the GDP is higher than expected, it will have the opposite effect. However, GDP data doesn’t always impact the currencies in an expected way and you should remember this while conducting trades.

The below table shows the GDP per capita forecast for 2020, 2021 and 2022 for some of the top economies of the world.

- Retail sales. A lion’s share of a country’s economic condition is represented by consumer spending. This economic indicator helps you measure the net consumer expenditure in several different sectors. When the retail sales go up, it shows that the customers have the excess money needed to buy luxury services and goods, while positively impacting the economy.

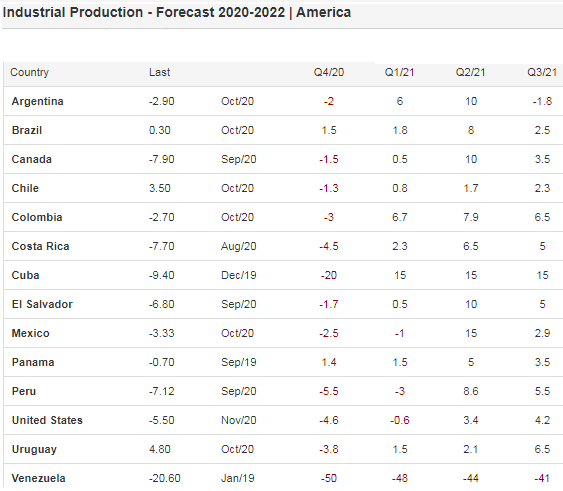

- Industrial production. This indicator signals a shift in industrial production in a country. It further indicates the extent to which the maximum capacities of the factories are being utilized. This is an important indicator for those investors who focus on the production of utility.

Utility production has high volatility due to the fact that it depends on weather fluctuations, which can lead to the reports being corrected, thus making the domestic currency highly volatile. As you can see from the table below, the dollar forecast in this respect looks optimistic. So it does for the currencies of other countries like Mexico and Peru.

- Consumer Price Index (CPI). When it comes to finding out the value of a currency, CPI is one of the most vital economic indicators you can use. It measures the mean shift in prices of products and services during a certain period of time. The customer has to purchase a product or service of the same category based on these prices.

As a general rule, we calculate the CPI on a monthly, yearly, or quarterly basis, but some investors might look at the shorter-term reports as well. With this indicator, traders can get an idea about the inflation occurring at the customer level. This is a huge cause of concern for central financial institutions.

Inflation occurs when the prices of products and services increase rapidly. The economy turns weak with the CPI tending to rise. When the CPI falls, the inflation gets reduced and the economy becomes strong.

How to use the fundamental analysis?

If the intrinsic value of a currency pair exceeds the current market price, it is an undervalued pair and you should make a purchase since the price has a high chance of moving up, as indicated by fundamental analysis.

Conversely, if the intrinsic value lies below the market price, traders look to sell the overvalued pair, given the fundamental analysis predicts a downward movement. Long-term traders take the help of fundamental analysis since the price for an undervalued pair is likely to rise.

They will typically enter long trades with undervalued pairs and short trades with overvalued ones.

Conclusion

Thus, you got to know about fundamental analysis in Forex and the various financial indicators that impact the prices of currencies. You also need to understand the basics of geopolitics and macroeconomics to successfully carry out fundamental analysis. Some of the elements might last longer than others, but trading with them is likely to bring you substantial rewards.

Leave a Reply