Source: IHS Markit Eurozone manufacturing slowed to an eight-month low in October, as supply issues dampened production during the month. EZU is up 0.91%. The final IHS Markit Eurozone Manufacturing PMI stood at 58.3 in October, lower than the flash estimate of 58.5 and lower than 58.6 in September.The latest reading is the lowest level in eight months since February.The … [Read more...] about Eurozone Manufacturing Falls to Eight-Month Low

Forex News

US Dollar Index (DXY) Prediction Ahead of FOMC and NFP Data

The US dollar index (DXY) has erased some of the spectacular gains it made on Friday after the US published the latest personal consumer expenditure (PCE) and income data. The index has declined to $93.93, which is about 0.45% below the highest level on Friday last week. Fed decision ahead The dollar index has declined as focus shifts to the Federal Reserve, which will … [Read more...] about US Dollar Index (DXY) Prediction Ahead of FOMC and NFP Data

US Manufacturing Sector Slows to 10-Month Low in October

Source: Markit Economics The American manufacturing sector growth slowed to a ten-month low in October, dragged by supply chain shortages. The seasonally adjusted IHS Markit US Manufacturing Purchasing Managers’ Index stood at 58.4 in October, down from 60.7 in September.The latest figure in the manufacturing sector was the weakest for 10 months.The overall upturn was … [Read more...] about US Manufacturing Sector Slows to 10-Month Low in October

Yellen Wants the Dems to Solve Debt Limitations The Other Way

Source: Reuters US Treasury Secretary Janet Yellen wants the Democrats to address the country’s debt limit issue if the Republicans do not rally behind them to avert a possible default next month. SPY is down -0.096%, DXY is down -0.09%. Yellen says that the Democratic Congressional leaders could use reconciliation to drive the debt ceiling bill. She added that the … [Read more...] about Yellen Wants the Dems to Solve Debt Limitations The Other Way

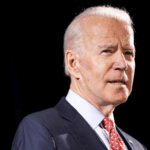

OPEC+ Headed for a Clash With Biden As Key Members Reject Call For Output Increases

Source: Bloomberg. OPEC+ is on a path for a clash with the United States as more members rejected President Joe Biden’s push for the group to raise oil production faster and help to cut gasoline prices. CL1! up +1.03% On Monday, Kuwait stated that the cartel should hold on to its plan to expand output gradually as oil markets were well-balanced. That followed supporting … [Read more...] about OPEC+ Headed for a Clash With Biden As Key Members Reject Call For Output Increases