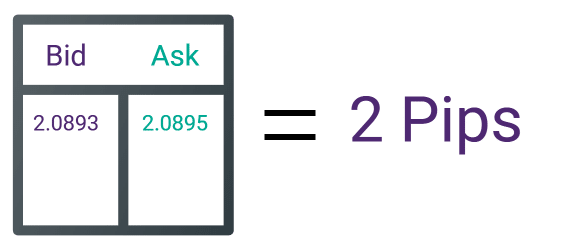

The concept of spread in forex trading is important for every newbie in the forex business because it will affect the costs you will come face to face with. By default, traders who have low spread will encounter lower costs of operation and more money saved. If you are a high spread trader, you will have to make more money to cover the costs incurred.

As a trader, you have to consider the spread, along with your profits even before you begin trading. If each trade will cost 6 pips, you have to cover at least 5 pips before talking about profit. When you calculate your forex spread, you will be able to tell if the cost incurred is reasonable for your style and if there are proper trading strategies in place.

Importance of Spread in trading

Among other factors, forex spread represents one of the most vital factors to consider before you choose your forex broker. Traders and investors alike ought to be better informed about the shortage of data about the tendency to manipulate these spreads on the platforms of the forex trader without seeking the client’s approval.

There are situations where dubious brokers use this practice to make higher gains. It is, thus, imperative to go for a broker with a proven track record, one who does not engage in manipulating the spreads. You cannot be hundred percent efficient in this trade but getting equipped with relevant information protects you from unwanted situations.

Classes of Spread

There are two classes of spread you should never forget, namely the high and low spread. Each one has its unique peculiarities; therefore, understanding them better positions you for a fruitful experience.

High spread

When there is a huge difference between the asking and bid price, it is called a high spread. Usually, currencies traded in emerging markets come with higher spreads than those of higher currencies. Emerging market trade lowers volumes when compared with major currency pairs. The higher the volume of trade, the lower the spread is in an ideal situation. When there is a higher spread, it could be a pointer to lower liquidity levels and higher volatility.

Low Spreads

Lower spreads are a pointer to the reduced difference between the asking and bidding price. Whenever you notice a low spread, it means that the volatility level is low with accompanying high liquidity. You are in a better position when you begin trading. In a situation where there is an opinion-shaping event, such as the Coronavirus pandemic, the spread may become wider.

Spread Types

There are two types of spread in the market. They are variable and fixed spread.

Fixed spread

With fixed spreads, the prevailing conditions of the market have little or no effect. Fixed spreads apply to currency pairs such as USD/GBP, EUR/USD, and USD/JPY. In such currency pairs, the mean spread variations aren’t much. Some of the benefits of fixed spreads include a lower capital need and the trustworthiness of the strategies. There is also the predictability of the costs of the transaction.

Variable spreads

This type of spread is often set by the trader at a lower limit. It may be subject to fluctuations. Also, the changes in the value of the currency may affect the variable spread. Variable spreads have some unique benefits, such as better pricing and more transparency. In more volatile markets, fixed spreads are always ideal.

Final Thoughts

As it is with all other ventures, understanding the dynamics of trading puts you in a better position to maximize your experience and earn profits. Spreads can seem complex for a novice trader but understanding the concepts and terminologies gives the trader an edge. Variable and fixed spreads have their unique benefits and demerits. Thus, you must study each of them properly.

Leave a Reply