Forex trading can be a jungle for those who are not aware of how the financial markets function. A bear trap is amongst one of the traps that one can fall prey to. Bear traps can have devastating consequences when traders fall prey to them. They seem to indicate the onset of a downturn but in reality, lead to a steady increase in the price. In this article, we take a look at what a bear trap is and how one can identify it and safeguard one’s account from it.

Bear Trap Conditions

Before a bear trap can reveal its jaws, the basic condition required for its manifestation is a pre-existing bullish trend in the market. Most traders ride this trend and make quick money. But, one can get caught up in the falsity of the sharp reversal of this bullish trend.

The reversal of this trend could be indicative of the entering of a new fund in the market in order to wring out small traders. However, this reversal is sometimes seen by bearish traders as an opportunity to get top dollar on their trade. Traders short the market because of its seeming overvaluation or due to the belief that a trend correction is soon likely to happen.

These false reversals occur for a very short period of time and anyone looking to short the market can get caught up in the trap.

How to look for a Bear Trap

Let us take an example to clearly figure out how one can spot a bear trap. Let’s assume that a trader in the market with bullish conditions spots a sudden selloff. The trader should look to confirm if this reversal is any good by checking if there is a higher trading volume or if there are any other external factors that justify this trend reversal.

If any of these criteria are met, then the trader can see the move as a bear trap and expect the market to resume the trend again after this temporary reversal is overcome. The trader should hold on to the long and wait until the high points are tested again.

Graphical representation of a Bear Trap

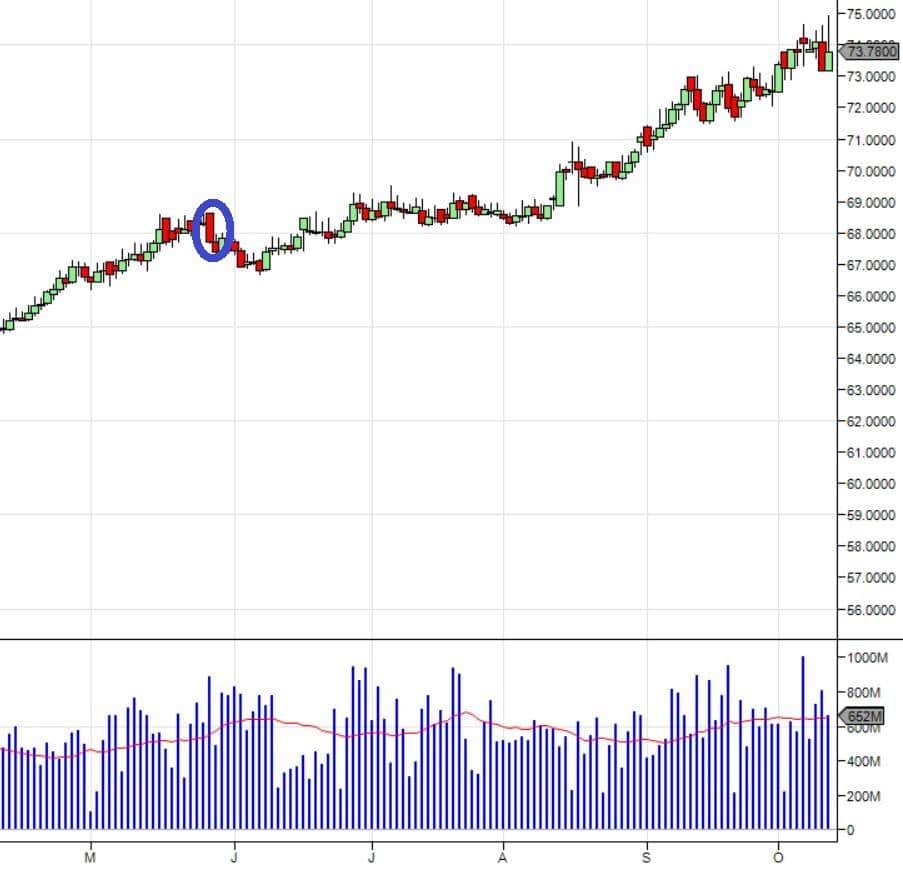

Let us see what a bear trap looks like in live markets. In the image below, the USD/INR shows a sharp rise. During this phase, the pattern witnessed a huge selloff that came in conjunction with a rise in the trading volume.

Immediately after the selloff, for two days the market gave a bearish indication. However, as soon as the markets returned to their bullish ways and the highs were retested, the rally continued and the markets closed higher than expected.

Here is a typical bear trap example. All those traders who thought the rally was finished and shorted the market were definitely in for a surprise trap.

Avoiding a Bear Trap

The tried-and-tested method of avoiding any slip-ups and the bear trap is to practice effective risk management strategies. This includes having a preconceived exit measure and a stop-loss in place. Timing one’s entries/exits can make a huge difference in the outcome.

Another way to safeguard oneself against the bear trap is to place the stop loss point at the current high and look to enter a short trade.

Conclusion

Bear traps are easy to fall prey to if one doesn’t understand how they work and how to spot them, especially in the intraday forex market since this is where they usually occur. But, if a trader is prudent and cautious enough and looks for confirmation before shorting a market, s/he will successfully avoid such traps of the market.

Leave a Reply