- The euro continues to strengthen across the board, supported by an improved EU economic outlook.

- The Chinese yuan continues to gain ground against the dollar amid optimism about the Chinese economy’s health and outlook.

- US indices remain on edge amid inflation jitters which could cause the FED to alter monetary policies.

- Bitcoin is in consolidation mode, opting to trade in a range even as Ethereum continues to set new all-time highs.

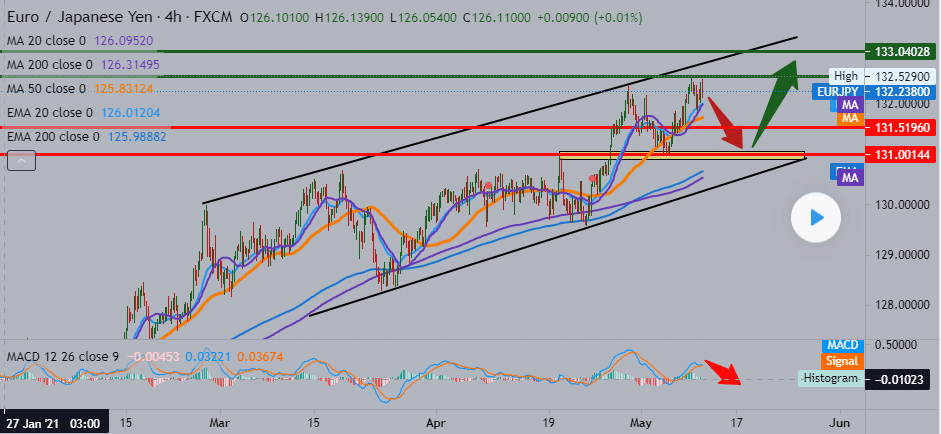

The euro has been one of the best-performing currencies, explaining why EUR/JPY is flirting with two-year highs. The common currency has benefited from improved EU economic outlook going by the solid economic releases in recent weeks.

Euro strength

The euro has also benefited from broader dollar weakness in recent weeks. The Non-Farm Payroll disappointing sent the dollar lower with the common currency strengthening across the board. On the other hand, the yen has been under immense pressure amid growing concerns about the Japanese economy, hard hit by the pandemic.

Weakness in the Japanese yen is one of the reasons EUR/JPY is trading multi-year highs.

The pair is currently in consolidation mode oscillating between 131.70 and 132.00 levels. At this juncture, the bulls are in firm control, driven mainly by euro strength across the board. A breach of the 132.09 resistance level should pave the way for the pair to rally back to the 132.59 level.

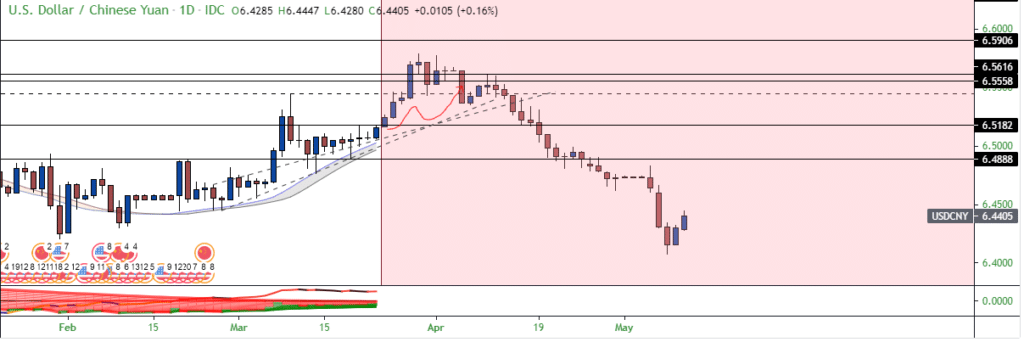

Chinese economy boost

The Chinese yuan is another currency strengthening across the board. The onshore yuan continues to strengthen against the dollar amid signs the Chinese economy is pulling ahead of others. The currency exchange rate against the dollar has since dropped to 6.4403, levels last seen in 2018.

The Chinese yuan started rebounding in April and is likely to continue strengthening given the prevailing weakness in the dollar. The yuan is also being supported by capital inflows and a large trade surplus.

Oil prices bounce back

In the commodities market, oil prices edged higher amid a robust demand outlook. US West Texas Intermediate has already retaken the $65 a barrel level with the $66 a barrel level insight. Brent Crude futures are also rising with $70 a barrel level insight.

The Colonial Pipeline outrage is one factor supporting higher oil prices as it continues to cause shortages in the Eastern United States. US oil prices have already hit 6-year highs at $2.99 a gallon. A prolonged outage in the US would be supportive of higher oil prices.

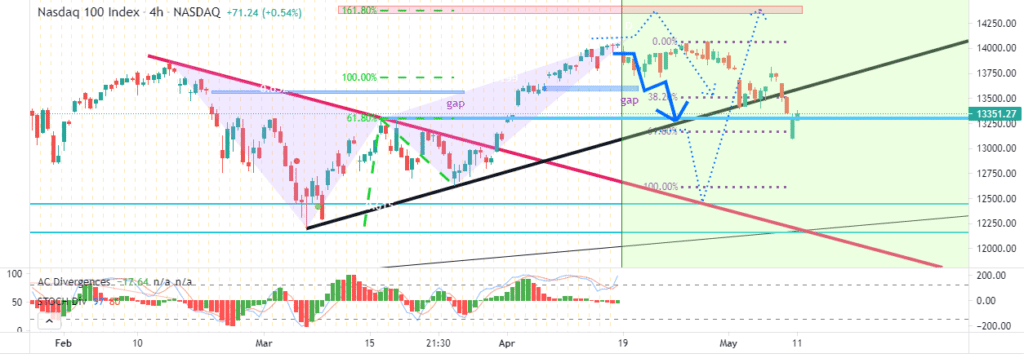

Indices sell-off

Major US indices remain on edge after a recent lower correction. The sell-off has come at the backdrop of inflation jitters which many investors fear could force the Federal Reserve to reconsider its ultra-loose monetary policy.

Tech laden, NASDAQ 100 has been the hardest hit, tanking by more than 6% from its all-time highs. Rising commodity prices and labor shortage concerns have also weighed heavily on the S&P 500, which is down 2% from its record highs.

Assets under management in exchange-traded funds have been on the rise in recent years as investors’ eye-diversified exposure. For the first time, ETFs are on course to eclipse mutual funds on assets under management.

Assets under management in ETFs stood at $7.71 trillion as of last year, slightly behind $7.76 trillion for mutual funds. It is highly likely ETFs have usurped mutual funds given the strong inflows registered so far.

ETF’s popularity stems from the fact that they trade like stocks allowing investors to hop in and out with ease on exchanges. In contrast, mutual funds only accept money and redemptions at the end of each day.

Bitcoin consolidation

Bitcoin is still struggling for direction as it continues to trade in a tight trading range of between $56,000 and $59,700. Failure to take out the $60,000 level after a recent bounce back appears to be fuelling the current push lower.

While Bitcoin has resorted to trading in a range, other altcoins have continued to experience wild swings. Ethereum has since powered to all-time highs of about $43,000. Dogecoin, on the other hand, has pulled lower after rallying to record highs of $0.7400.

Leave a Reply